Taxes/McCleary Impact

Educational Taxes Explained

There are three components that make up the educational tax base in Walla Walla; the school bond, the school levy, and the state school tax levy. The school bond (dark blue above), currently at $1.23 / $1,000 is what local voters will consider replacing in the upcoming election as the previous bond will be completely paid off this year. One of the lower school bond rates in the region, it will net $65.6M local and is eligible for $52.6M in state match.

The school bond (dark blue above), currently at $1.23 / $1,000 is what local voters will consider replacing in the upcoming election as the previous bond will be completely paid off this year. One of the lower school bond rates in the region, it will net $65.6M local and is eligible for $52.6M in state match.

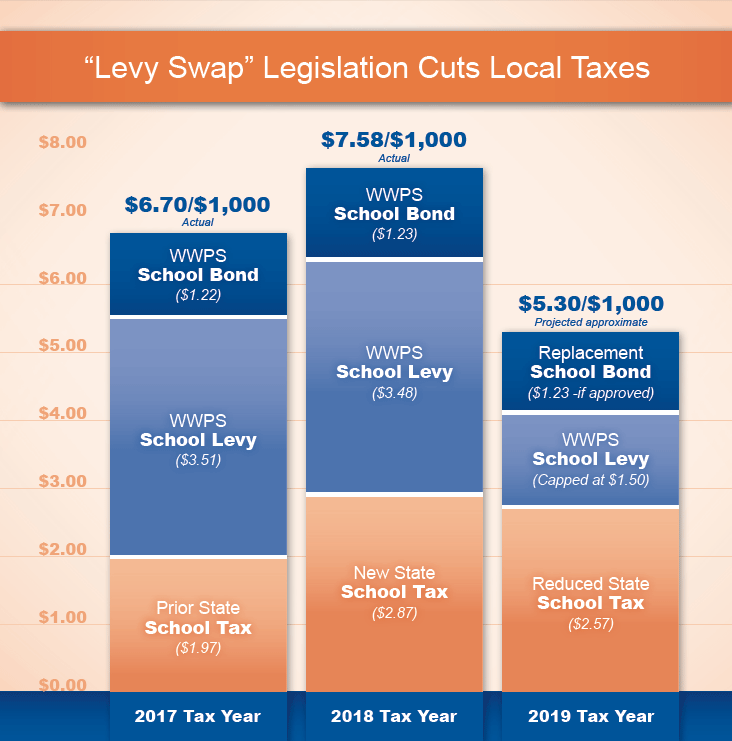

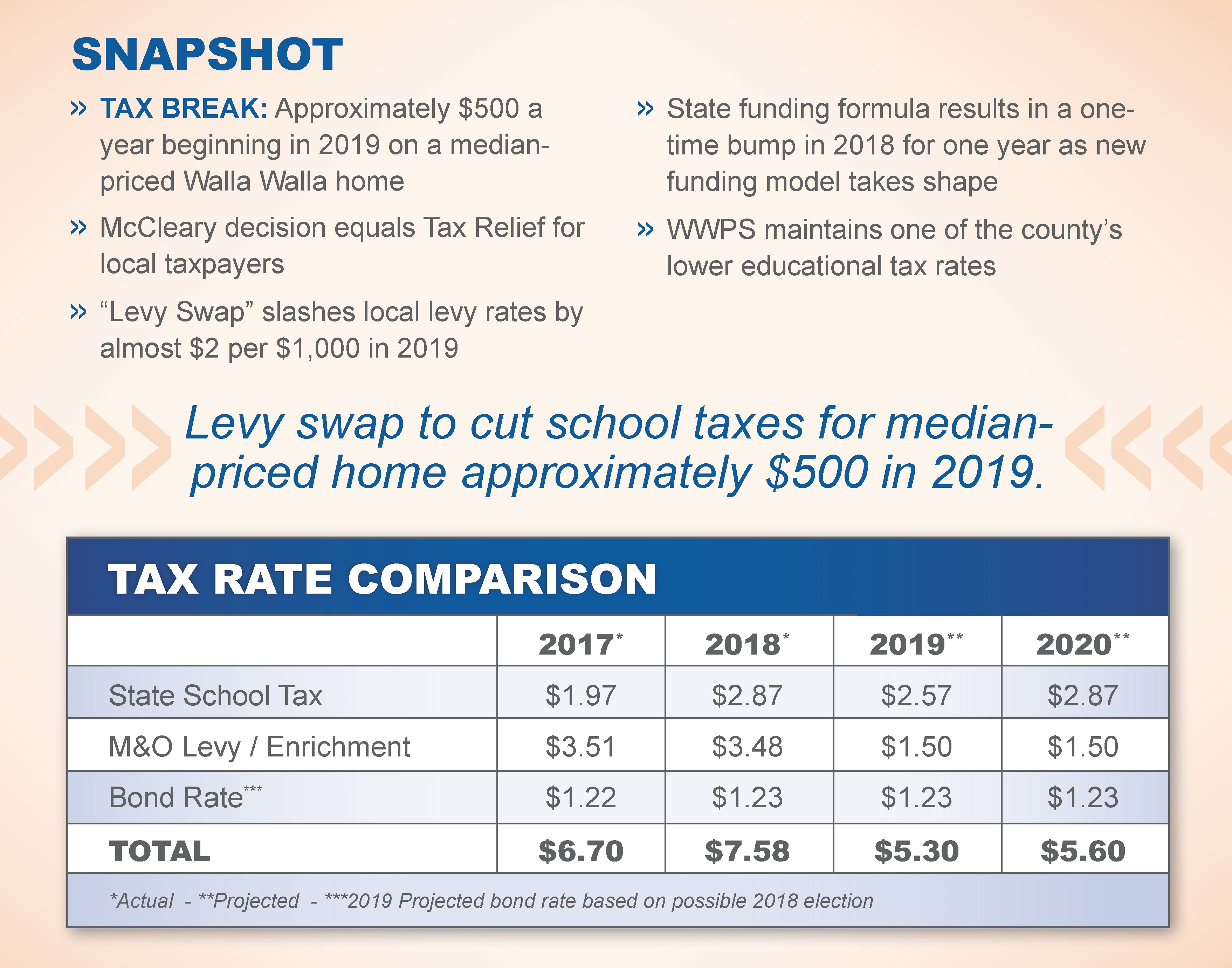

The school enrichment levy, also referred to as the "learning levy," (light blue above), was approved by voters in 2016. The enrichment levy does not fund capital improvements. Rather, it pays for educational activities such as advanced placement courses, music, drama, fine arts, career and technical education, extracurricular opportunities, and other program experiences that the state does not fund in its basic school apportionment. The enrichment levy, approved by local taxpayers for over three decades in Walla Walla, requires voter renewal every four years. The voter-approved levy has resulted in approximately a $3.50 / $1,000 rate for local taxpayers in recent years. However, in 2018 the legislature enacted the "McCleary" fix that encompassed a number of tax changes. Specific to enrichment levies, ESSB 6362 was enacted, which capped local enrichment levies at $1.50 / $1,000, resulting in an approximate $2.00 / $1,000 rate decrease for Walla Walla taxpayers beginning next year. If voters reauthorize the enrichment levy in 2020, ESSB 6362 permits only an inflationary adjustment over the new $1.50 /$1,000 cap in future collection years.

The state education property tax levy (orange above), was greatly impacted by the McCleary funding fix. First, to clear up a misunderstanding, the state property tax rate for schools is not set to increase to $3.60 in 2022. In fact, the $3.60 maximum ceiling is not new and has been in Washington state law since 1973 (see page 1533):

When the Legislature passed the "McCleary" funding bills (EHB 2242/ESSB 6614/ESSB 6362), it took the old state schools tax rate (that had fallen to approximately $1.97 / $1,000 for Walla Walla), and added a second state-wide schools tax on top of it, raising the total tax rate to approximately $2.87 / $1,000 for local taxpayers (shown above and below).The McCleary legislation holds the combined rates flat for four years (2018-2021), other than a temporary 30 cent relief in 2019 (shown below). The 4-yr McCleary rate adjustment sunsets in 2022, reverting to the historical "pre-McCleary" rules subject to the $3.60 maximum cap and 1% growth limit on revenue that applies to Washington state education property taxes. What this means in practice is that the state property tax rate in 2022 will not jump to $3.60 due to the “limitations of chapter 84.55 RCW” that may be found here: http://app.leg.wa.gov/RCW/default.aspx?cite=84.55.010 and further clarified here: http://app.leg.wa.gov/RCW/default.aspx?cite=84.55.005 In fact, if history is any indication, it has tended to recede over time, falling considerable from its state-wide high point of $3.59 / $1,000 in 1997.This rate reduction is a result of the 1% growth limit placed on the state education tax. The limit prescribes that the state cannot collect more than 101% revenue statewide from previous year taxpayers to the next (e.g. the 1% limit). As statewide property values continue to increase, as many of us have witnessed locally, the state is required to lower the tax rate so that they do not collect revenue in excess of the 1% budget growth factor described in statutes linked to above.

What this means in practice is that the state property tax rate in 2022 will not jump to $3.60 due to the “limitations of chapter 84.55 RCW” that may be found here: http://app.leg.wa.gov/RCW/default.aspx?cite=84.55.010 and further clarified here: http://app.leg.wa.gov/RCW/default.aspx?cite=84.55.005 In fact, if history is any indication, it has tended to recede over time, falling considerable from its state-wide high point of $3.59 / $1,000 in 1997.This rate reduction is a result of the 1% growth limit placed on the state education tax. The limit prescribes that the state cannot collect more than 101% revenue statewide from previous year taxpayers to the next (e.g. the 1% limit). As statewide property values continue to increase, as many of us have witnessed locally, the state is required to lower the tax rate so that they do not collect revenue in excess of the 1% budget growth factor described in statutes linked to above.

This limiting factor is similar to the situation Walla Walla will be in with this proposed bond. If local property values continue to climb at current levels, the bond tax rate will either decline from the $1.23 projected and/or be used to pay off the debt quicker, depending on the structure of the bonds once sold. With a bond the district only collects the total fixed amount of total revenue the voters have authorized ($65.6M).

Click HERE to watch a brief video from Superintendent Wade Smith explaining the tax implications of the McCleary Decision. This historic legislation centered on how the state funds basic education significantly lowers local school property taxes.

If you have any questions about tax implications, please do not hesitate to contact the district office at anytime.